DOL Publishes Updated AEWRs for H-2A Range and Non-Range Occupations

Publicado el lunes, 16 de diciembre de 2024

The U.S. Department of Labor has published two Federal Register Notices (FRN) reflecting the updated Adverse Effect Wage Rates (AWER) applicable to Range and Non-range H-2A occupations respectively. The Range FRN will update the AEWR that applies to all range H-2A job opportunities, which is determined using the Bureau of Labor Statistics (BLS) September 2024 Employment Cost Index (ECI). The Non-range FRN will update the AEWRs that apply to the majority of non-range H-2A job opportunities which are determined using the USDA’s annual Farm Labor Survey (FLS).

Range FRN

Effective January 1, 2025, any H-2A employer certified or seeking certification to employ workers to engage in the herding or production of livestock on the range must pay each worker a wage that is at least the highest of the various wage sources listed in § 655.211(a)(1), including the monthly AEWR of $2,058.31, at the time work is performed on or after the effective date of the FRN. DOL has promulgated separate H-2A regulations governing range job opportunities given the unique nature of such work.

Non-range FRN

In late-November 2024, the USDA released its annual Farm Labor Survey (FLS) wage data report for which DOL historically relies upon when updating the AEWRs for upcoming year. On December 12th, DOL previewed the updated AEWRs for each state (reflecting the minimum hourly wage rate employers must pay to workers performing job tasks/activities encompassed within one or more of the “Big Six” Standard Occupational Classification (SOC) codes.

The Big Six codes include:

Farmworkers and Laborers, Crop, Nursery, and Greenhouse (45-2092);

Farmworkers, Farm, Ranch, and Aquacultural Animals (45-2093);

Agricultural Equipment Operators (45-2091);

Packers and Packagers, Hand (53-7064);

Graders and Sorters, Agricultural Products (45-2041); and

All Other Agricultural Workers (45-2099).

DOL also recently reported that 96% of all job opportunities certified in 2024 resulted in H-2A and domestic workers in corresponding employment receiving a Big Six SOC code.

Quick Hits

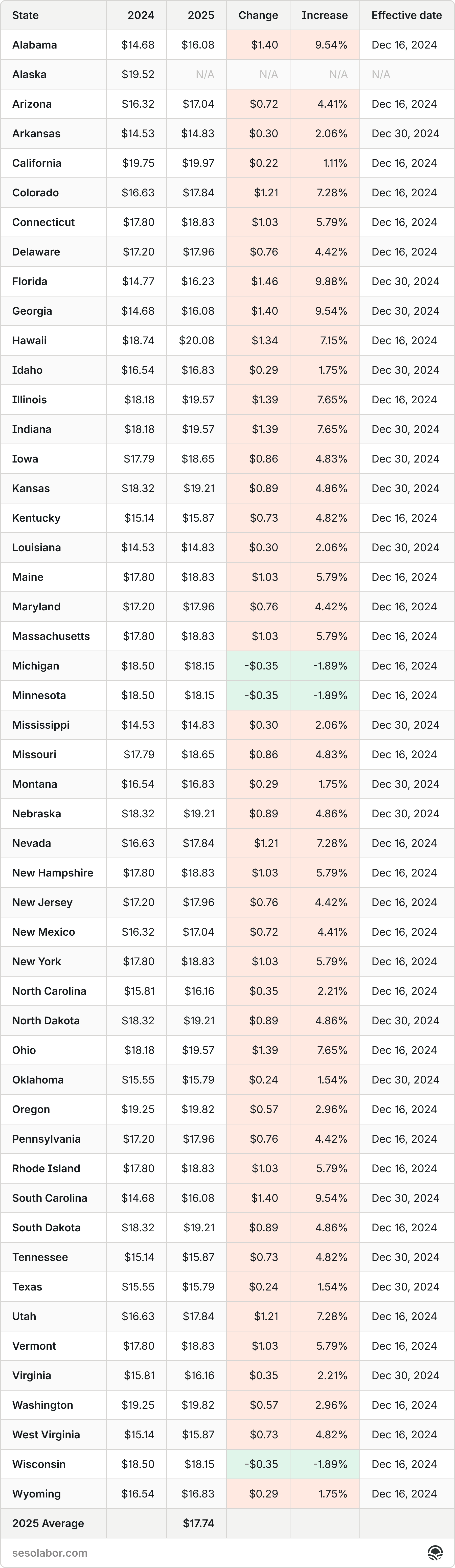

4.5% national increase over 2024 wages to $17.74/hr.

*Same rate that will now be used to calculate surety bond amounts for H-2ALCs

Hawaii reported the highest single wage at $20.08/hr.

Great Lakes (Michigan, Wisconsin, Minnesota) was the only region to see wage decrease by 1.9% ($18.50 to $18.15/hr).

When do the updated AEWRs take effect?

Either December 16 or 30, 2024, depending on which state(s) the place of employment is or will occur. Employers are required to offer and pay the updated AEWR as soon as it becomes effective.

While the FRN initially states that the new wages are effective as of December 16, 2024, it subsequently clarified that regarding any work performed at a location within any of the 17 states subject to the Southern District of Georgia’s preliminary injunction order in Kansas et. al. v. U.S. Department of Labor, including AR, FL, GA, ID, IN, IA, KS, LA, MS, MT, NE, ND, OK, SC, TN, TX, VA, employers will receive the benefit of a 14-day notice period before the updated AEWRs will carry force of law on December 30, 2024, because DOL is currently prohibited from enforcing the Farmworker Protection Rule in those 17 states, including the new “effective upon publication” obligation for employers to immediately pay the workers the updated AEWR. Conversely, for work performed at places of employment located in any of the 33 states that are not subject to the Kansas Order, the effective date applicable is December 16th.

Is there a chance that the DOL could seek to withdraw the Farmworker Protection Rule following the injunction/stay orders issued against DOL by federal courts in Georgia, Kentucky, and Missouri?

Unlikely at this time despite the H-2A stakeholder community’s continued urging for DOL to do so. As a footnote to the FRN indicates, DOL has apparently decided to continue its defense and enforcement efforts of the Rule notwithstanding its patchwork status or ever-increasing likelihood that it will be struck down in its entirety by one of the four presiding district courts:

“Neither the preliminary injunction issued in Barton, et al. v. U.S. Department of Labor, et al., No. 5:24-cv-249-DCR (E.D. Ky., Nov. 25, 2024), nor the Section 705 stay issued in International Fresh Produce Association, et al. v. U.S. Department of Labor, et al., No. 1:24-cv-309-HSO-BWR (S.D. Miss., Nov. 25, 2024) affect DOL's implementation or enforcement of 20 CFR 655.120(b)(2) as to the parties or entities subject to those orders.”

Until the H-2A stakeholder community receives any evidence or indication to the contrary, it’s full steam ahead on the litigation train.

What if an AEWR update falls in the middle of my pay period?

In published guidance regarding the Farmworker Protection Rule, DOL has advised that it “will not take enforcement action against you if you can demonstrate it was impossible to update payroll before the next scheduled pay date and you provide retroactive pay for the difference in the following pay period.” However, given that this guidance preceded the issuance of the Kansas Order, employers who are afforded the benefit of 14 days’ advance notice should be prepared to demonstrate their timely compliance to DOL in an audit.

I have work being performed currently or in the near future at places of employment that are located within one of the three states (MI, WI, MN) that experienced a wage rate decrease via updated AEWRs published by DOL. Can I pay my workers the lower wage rate upon it taking effect?

The decreased wage rates in these three states do not apply to any active work contract (i.e. post-certification stage) that previously guaranteed a higher wage rate to workers. Instead, the employer must continue to honor the higher wage rate through the remainder of the contract.

Rule of Thumb: Updated AWERs can only result in higher pay to workers, never lower.

To realize the benefit of a lower wage rate, employers should immediately submit a pre-certification amendment request to DOL with regard to any pending job order/application. While employers may still seek to withdraw an application/job order that has progressed to post-certification stage, an employer is still obligated to comply with the terms and conditions of employment contained in application/job order with respect to all workers recruited in connection with the job opportunity. Additionally, a post-certification withdrawal often results in significant delays in worker arrivals assuming the employer initiates a new filing for the same job opportunity.

Bulleted list of AEWR rates

Alabama

2024: $14.68

2025: $16.08

Alaska

2024: $19.52

2025: N/A

Arizona

2024: $16.32

2025: $17.04

Arkansas

2024: $14.53

2025: $14.83

California

2024: $19.75

2025: $19.97

Colorado

2024: $16.63

2025: $17.84

Connecticut

2024: $17.80

2025: $18.83

Delaware

2024: $17.20

2025: $17.96

Florida

2024: $14.77

2025: $16.23

Georgia

2024: $14.68

2025: $16.08

Hawaii

2024: $18.74

2025: $20.08

Idaho

2024: $16.54

2025: $16.83

Illinois

2024: $18.18

2025: $19.57

Indiana

2024: $18.18

2025: $19.57

Iowa

2024: $17.79

2025: $18.65

Kansas

2024: $18.32

2025: $19.21

Kentucky

2024: $15.14

2025: $15.87

Louisiana

2024: $14.53

2025: $14.83

Maine

2024: $17.80

2025: $18.83

Maryland

2024: $17.20

2025: $17.96

Massachusetts

2024: $17.80

2025: $18.83

Michigan

2024: $18.50

2025: $18.15

Minnesota

2024: $18.50

2025: $18.15

Mississippi

2024: $14.53

2025: $14.83

Missouri

2024: $17.79

2025: $18.65

Montana

2024: $16.54

2025: $16.83

Nebraska

2024: $18.32

2025: $19.21

Nevada

2024: $16.63

2025: $17.84

New Hampshire

2024: $17.80

2025: $18.83

New Jersey

2024: $17.20

2025: $17.96

New Mexico

2024: $16.32

2025: $17.04

New York

2024: $17.80

2025: $18.83

North Carolina

2024: $15.81

2025: $16.16

North Dakota

2024: $18.32

2025: $19.21

Ohio

2024: $18.18

2025: $19.57

Oklahoma

2024: $15.55

2025: $15.79

Oregon

2024: $19.25

2025: $19.82

Pennsylvania

2024: $17.20

2025: $17.96

Rhode Island

2024: $17.80

2025: $18.83

South Carolina

2024: $14.68

2025: $16.08

South Dakota

2024: $18.32

2025: $19.21

Tennessee

2024: $15.14

2025: $15.87

Texas

2024: $15.55

2025: $15.79

Utah

2024: $16.63

2025: $17.84

Vermont

2024: $17.80

2025: $18.83

Virginia

2024: $15.81

2025: $16.16

Washington

2024: $19.25

2025: $19.82

West Virginia

2024: $15.14

2025: $15.87

Wisconsin

2024: $18.50

2025: $18.15

Wyoming

2024: $16.54

2025: $16.83

Compartir este artículo

No hay artículos anteriores.

No hay artículos más recientes.

Aviso legal: La información proporcionada en este blog es solo para fines informativos generales. Toda la información en el sitio se proporciona de buena fe, sin embargo, no hacemos representación o garantía de ningún tipo, expresa o implícita, con respecto a la exactitud, adecuación, validez, confiabilidad, disponibilidad o integridad de cualquier información en el sitio. En ningún caso tendremos responsabilidad hacia usted por cualquier tipo de pérdida o daño incurrido como resultado del uso del sitio o la confianza en cualquier información proporcionada en el sitio. Su uso del sitio y su confianza en cualquier información en el sitio es únicamente bajo su propio riesgo.

El blog puede contener enlaces a otros sitios web o contenido perteneciente u originado por terceros o enlaces a sitios web y características en banners u otra publicidad. Tales enlaces externos no son investigados, monitoreados o verificados por nosotros en cuanto a su exactitud, adecuación, validez, confiabilidad, disponibilidad o integridad. No garantizamos, respaldamos, garantizamos o asumimos la responsabilidad de la exactitud o confiabilidad de cualquier información ofrecida por sitios web de terceros enlazados a través del sitio o cualquier sitio web o característica enlazada en cualquier banner u otra publicidad. No seremos parte o de ninguna manera seremos responsables de monitorear cualquier transacción entre usted y proveedores de productos o servicios de terceros.

¿Listo para aprender más?